Nick Gustafson – A Review of The Price of Time

A Review of the The Price Of Time: The Real Story of Interest by Edward Chancellor

September 2022

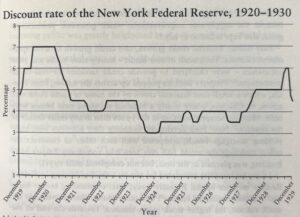

Even a casual observer of financial news can’t help but notice the non-stop coverage of the Federal Reserve’s aggressive raising of its benchmark short-term rate to the highest level since 2008.

The Federal Funds Rate is the interest rate at which banks lend money to each other on a short-term basis. The Federal Reserve is vigorously raising the costs of borrowing money to lower near double digit year-over-year inflation.

To put the rapidly rising cost of borrowing money in real terms, the monthly mortgage payment for a $500,000 home purchase in January 2022 would only service the payment on a $326,000 home in September 2022. That’s quite simply a dramatic loss of borrowing power.

While this sudden rise in the cost of borrowing money will slow many businesses such as auto sales, home sales, investment real estate, etc., it’s important to keep a historical perspective in mind.

I read the recently published book, The Price of Time: The Real Story of Interest last month and found some interesting takeaways and reminders:

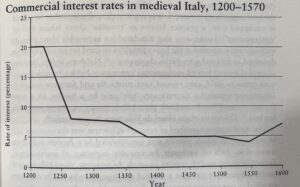

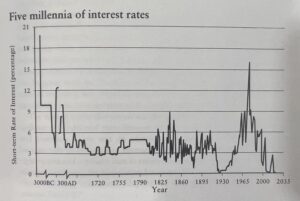

- Humans have been lending to each other for at least the last 5,000 years. We have loan details going all the way back to Mesopotamia. Loans were inscribed in cuneiform tablets, detailing interest rates, collateral, commodities exchanged, and more. Often these loans would range from 10%-33%. Sophisticated recorded loans with interest rates were made prior to the discovery of the wheel. Temples and palaces were some the ancient world’s most prolific lenders.

- Interest is the time value of money and lies at the heart of valuation. Discounting future cash flows generated by a stock, bond, building, or other income-producing asset, interest allows us to arrive at its present value.

- Politicians and political parties have debated the merits of low and high interest rates for hundreds, if not thousands, of years.

- As interest rates lower, asset values rise. As interest rates increase, asset values lower.

- Extremely long periods of low interest rates tend to create massive and destructive bubbles in equities and real estate.

- Innovation and productivity diminish in periods of excessively low interest rates as large companies will cease allocating capital effectively, and poorly run organizations can cheaply borrow money to effectively become “zombie” companies.

- In periods of excessively low interest rates, savers lose the value of their savings as risk-free returns diminish and are left with the decision to spend savings or increase their risk profile for additional yield.

There’s no doubt the dramatic increase in borrowing costs will be painful to many individuals and businesses over the next 12 months. However, an increase in the cost of borrowed capital will reset the rampant inflation we are experiencing at the grocery store, gas pump, construction site — and everywhere we turn.